The IMF’s managing director deemed reforms that would give Beijing greater voting rights in the institution necessary because he believed that without China’s support, other developing countries would also lose confidence in the fund, the IMF’s managing director wrote. Financial Times.

Photography: Mustafa Yalcin/Agence France-Presse

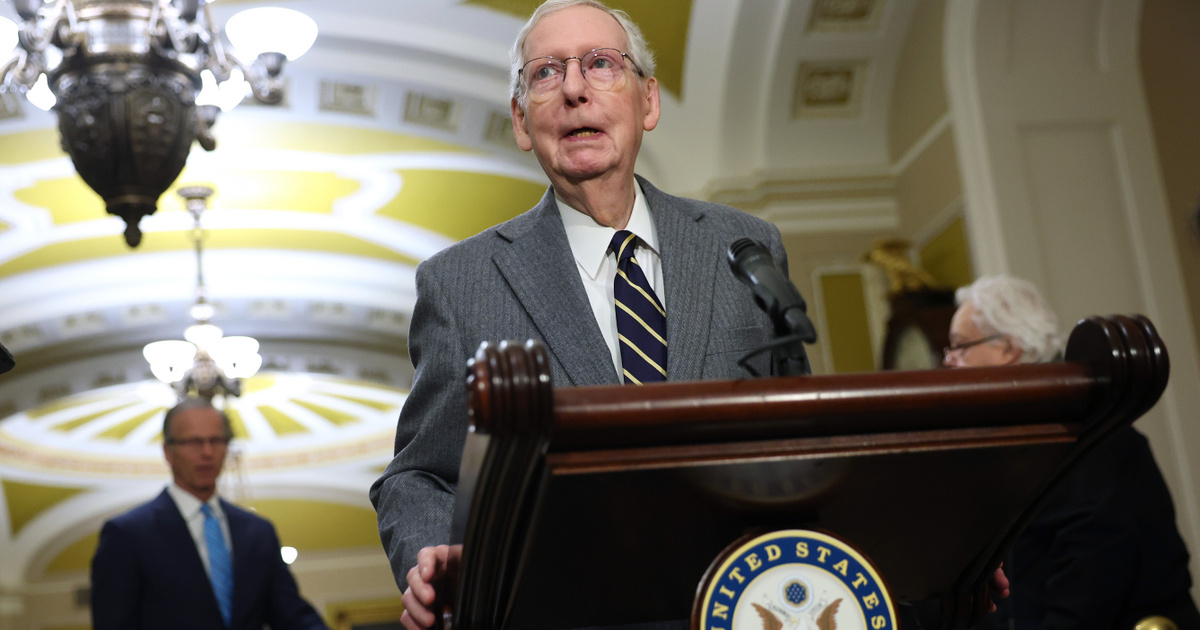

Kristalina Georgieva, a Bulgarian economist, has been leading the IMF since 2019, and is urging comprehensive reforms aimed at ensuring that the institution’s operations reflect the changes that have occurred in the global economy in recent decades, giving a good standing to emerging markets. Among these factors, he sees the rise of China as the most important, which, despite its size, remains marginalized in the currency base.

China has only 6% of voting rights in the International Monetary Fund, while its global weight is almost three times that. If this disparity does not change in the future, it is feared that Beijing will retreat from our institution

– warned Georgieva, who considers voting rights that reflect reality to be crucial for the effective operation of the currency fund.

Traditionally, each IMF member country gets what is called a quota, based on its position in the global economy, which determines its financial contribution, the weight of its votes, and its ability to access emergency financing.

Currently, China’s share is smaller than Japan’s. The United States has the largest weight in the IMF, with a 17% quota, giving it the right to veto quota decisions that require 85% support – according to the Fund’s head, these power relationships must change.

The IMF’s Board of Governors typically reviews quotas every five years, and last approved changes in 2010. Since then, China’s economy has registered remarkable growth and has been playing an increasingly active role in international politics.

We are at the center of the global safety net. If the Fund is unable to move with the world and create confidence in developing countries, we will not be able to help them in times of future economic, social and natural disasters.

The head of the International Monetary Fund said. In parallel with Georgieva’s proposals, the United States is working to strengthen the position of developing and emerging countries in Washington-based multilateral institutions, in order to increase Western influence against Russian and Chinese programs.

However, Georgieva would prefer to increase the organization’s resources so that it can deal with economic problems around the world – which is why, she says, there will be a great need for Chinese capital.

Photography: Jalal Gunes/Agence France-Presse

The CEO of the International Monetary Fund has long been a major supporter of China, and has spoken out even when he was interim head of the World Bank. China’s share of the currency fund does not actually reflect the size of its economy, and there is no doubt that the IMF will be able to provide assistance to struggling countries more effectively thanks to its enhanced support.

On the other hand, the IMF head has used less clean means in the past to give Beijing more power.

In 2021, an independent investigation found that in 2019, Georgieva instructed World Bank staff to correct data in the institution’s annual Doing Business report so that China would rank better. However, the IMF board gave confidence to the Bulgarian economist, saying that the investigation “did not prove beyond reasonable doubt” that he was actively involved in data falsification.

Because of the scandal, the World Bank stopped issuing Doing Business reports, although for years they had been an important tool for developing countries to attract foreign investment to their markets.

US officials indicated that they had left the door open to increasing China’s share in the future, but now they would veto any proposal that would expand Beijing’s voting rights in any way.

China, the world’s largest bilateral creditor, has been criticized by Western institutions and governments for years for its continuous obstruction of debt rescheduling agreements for distressed countries.

The work of Georgieva and the IMF has also come under increasing criticism for overseeing countries on the brink of bankruptcy, such as Argentina and Pakistan, which IMF programs are less able to help.