0.75% of the new installment

The Directorate General of Meteorology recently published new government security terms for tracking inflation for three years. The paper can be subscribed from July 1, i.e. tomorrow, but at a lower interest premium: While the previous series offered a 1% inflation premium, the new design now only gives 0.75%.

According to the prospectus, the paper will pay an interest rate of 1.9% in time proportion to the first interest period (compared to 3.3% of average inflation last year), after which the effective interest rate will depend on inflation and interest in the previous year. rate premium.

Why does the insurance premium go down?

Obviously, the reason for the low interest rate is that economic inflation. MNB expects inflation to reach 4.1% this year (Expect 3.8-3.9% a few months ago), the inflation report specifically indicates that the moderation in inflation will be slower than expected. As a result of intensifying inflationary pressures, the Hungarian Central Bank recently raised interest rates:

Thus, next year the newspaper may offer an interest rate of up to 4.85%, if inflation is in line with the expectations of MNB.

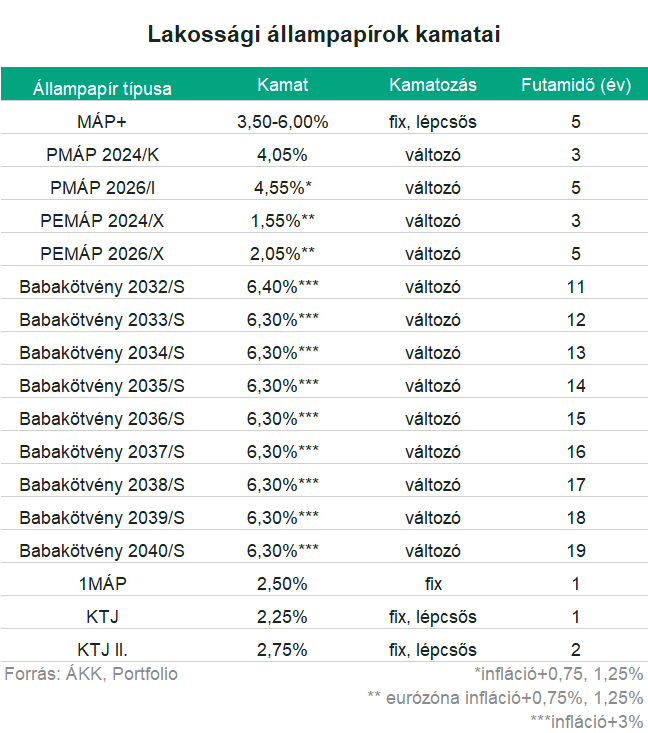

The interest rate premium on inflation-tracked five-year government bonds was lowered again in January, and the paper currently offers an interest rate premium of 1.25%. We’ve written more about this here:

So is it better to buy super government securities?

As mentioned earlier We wrote many timesAnd the

MÁP+ can be more attractive than a premium sheet to track inflation if average annual inflation does not exceed 3.7% in 5 years. The same average annual inflation rate over 3 years is 3.68%.

This results in a 5-year inflation tracking paper that pays an interest premium of 1.25% over inflation and a 3-year PMÁP a premium of 0.75%, so in the former case M theP + 4.95% 5-year premium in the latter case the interest premium must be deducted on the papers Finance to track inflation from the annual return of MÁP + 4.43%.

The inflation that gives the interest rate basis for inflation-linked government securities is always the previous year’s average annual inflation, so the interest calculated with this year’s inflation will be paid by the securities next year (as we wrote earlier).

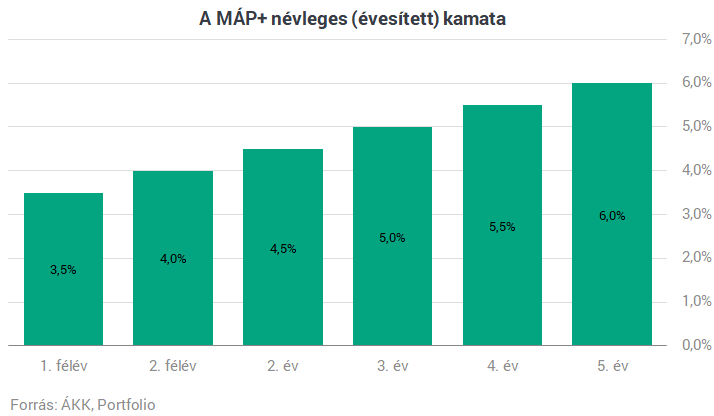

It is worth noting that MÁP + has an amazing interest rate: it does not promise a return of 4.95% in the first years. It is only issued at an annual average of 4.95% if someone keeps the paper for 5 years. The figure below shows the nominal interest rate: for example, in the first half of the year, the paper promises an annual return of 3.5%, that is, it pays 1.75% for half a year. In the second half of the year, the interest rate will be 4.0% per annum, that is, the interest payment will be 2%, after which the yield will increase annually. In addition, if a person does not withdraw his money within 5 business days of paying interest, these figures must be reduced by 0.25 percentage points (this is the redemption deduction).

Which paper is the best option depends on where the inflation goes. Incidentally, MNB estimates that inflation will return to around 3% from mid-2022 and stabilize there. Whatever scenario comes true, it can be helpful to hold the super government paper and keep track of inflation in our portfolio.

Cover Photo: Getty Images

![Does the Nintendo Switch 2 not even reach Steam Deck's performance? [VIDEO]](https://thegeek.hu/wp-content/uploads/sites/2/2023/06/thegeek-nintendo-switch-2-unofficial.jpg)