This year was also mainly affected by the economic impacts of the coronavirus pandemic. The government’s goal is to restart the Hungarian economy as soon as possible after the epidemic is curbed. Corporate support is key to achieving this, and so the government helps companies get quick-start, interest-free loans as well as investment incentive schemes, tax cuts and wage subsidies. The Finance Ministry said in a statement that the budget will continue to provide the full resources needed to combat the epidemic and revitalize the economy.

In the first month of this year, the central subsystem of the general government closed with a surplus of 198.8 billion HUF.

Within this, the central budget generated a surplus of 180.5 billion HUF, the separate state financed a surplus of 22.4 billion HUF, and the Social Security funds generated a deficit of 4.1 billion HUF. The development of the January 2021 surplus is not unusual, and this deficit can be explained by the seasonal course of the deficit within a year. According to current estimates, by 2021, the general government deficit is expected to reach 6.5% of GDP according to the European Union methodology.

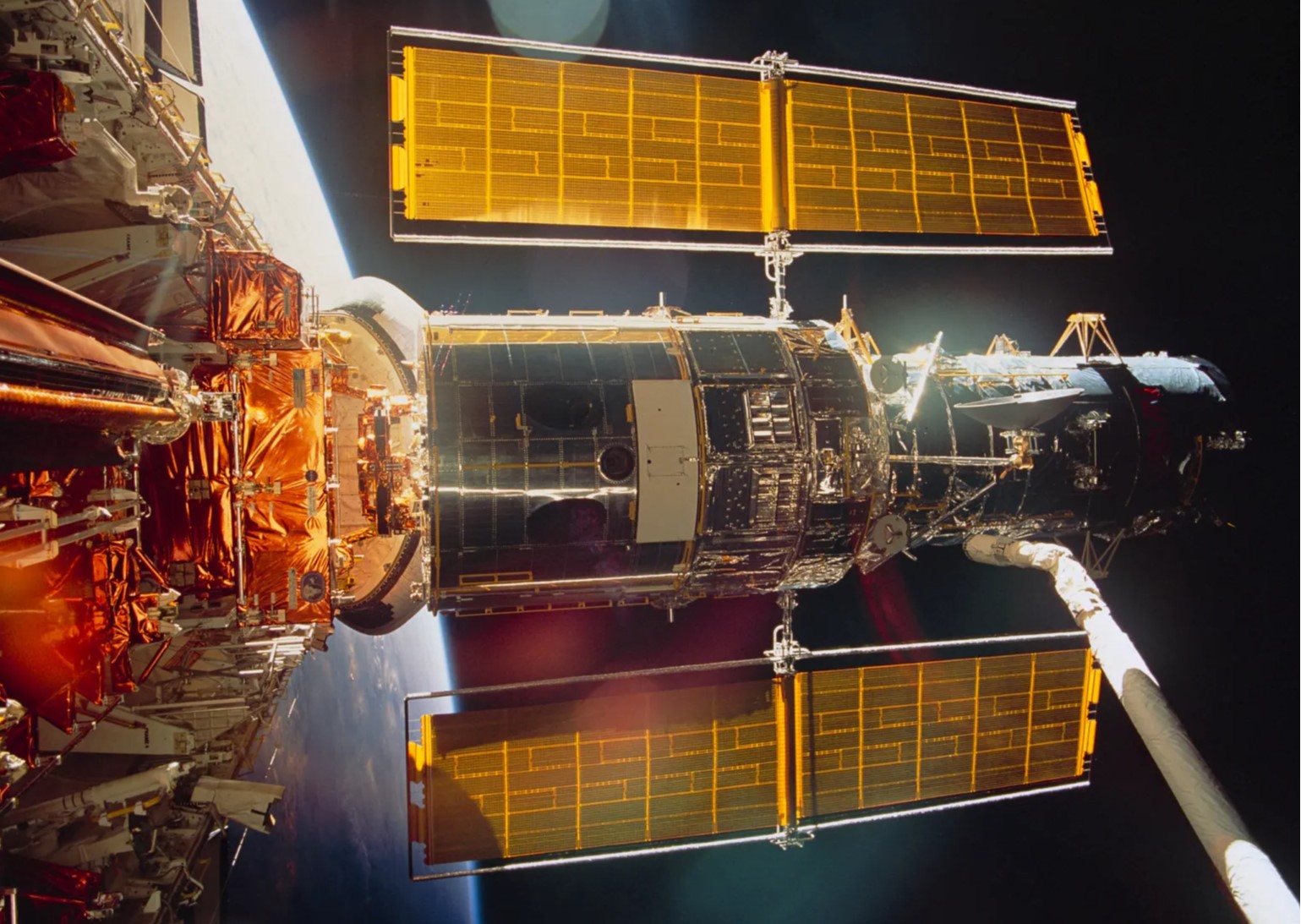

Photo: MTI / Lajos Soós

Pandemic control funds totaled 60 billion HUF in January.

Among the domestic expenditures, one can highlight the sums paid for the modern cities program (42 billion HUF) and 23.8 billion HUFs paid for the transport sector programs. The ministry wrote that as of January 1, 2021, there was also a 3 percent increase in pensions and some other benefits (including disability benefits, rehabilitation benefits, disability benefits, and spousal benefits).

The tax cut policy will continue this year, so that, as of January 1, the small business tax rate was reduced from 12 percent to 11 percent, and the value-added tax rate on the sale of newly built homes under the Home Improvement Action Plan was reduced again to 5 percent.

To mitigate the negative impact on the economy, entrepreneurs in the hospitality and tourism sectors have been exempted from paying the employer’s tax burdens from November of last year until the end of January 2021.

In addition, until January 31, 2021, the government extended the wage subsidy program in the tourism and hospitality sector, in addition to extending the program to travel companies. Thus the previously granted wage subsidies are funded by the government in order to overcome bureaucratic hurdles. The statement said the government will provide additional support as part of the economic easing action plan.