The Council of the European Union has agreed to include the Hungarian business tax in the global minimum tax – this was revealed in an official letter obtained by Világgazdaság.

This is what the General Secretariat of the Council of the European Union has indicated and according to what has been described

The global minimum tax can be applied at home without increasing taxes.

“This is a Hungarian success,” our sources assessed.

A quick guide to global minimum taxes

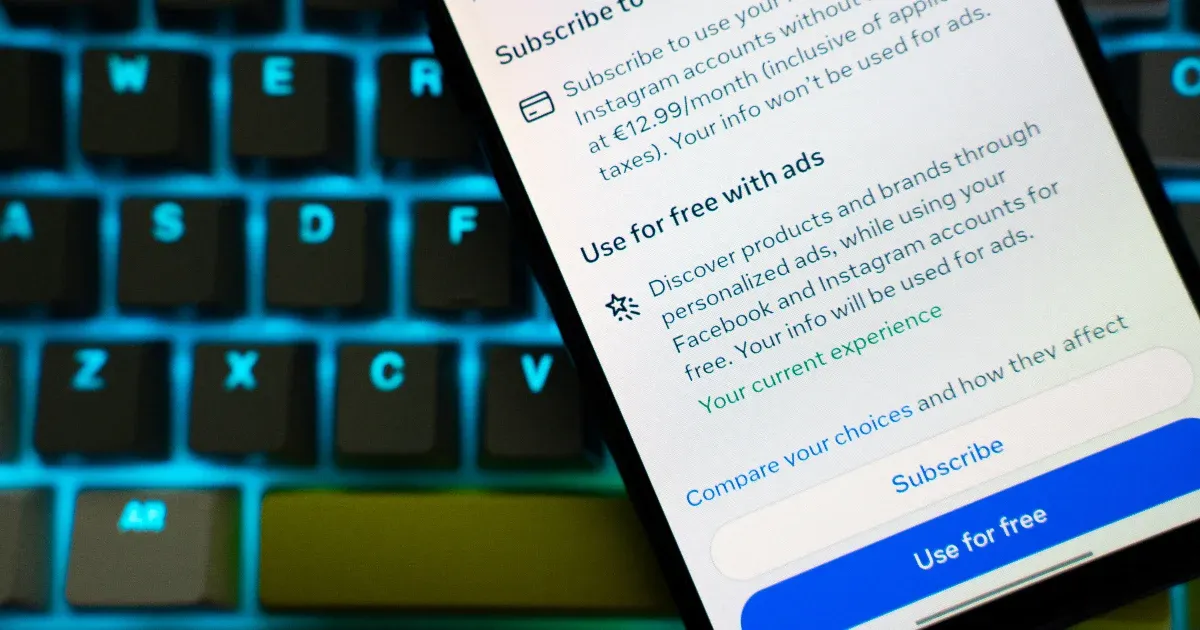

Just like that Our newspaper previously reported several times, 137 countries in the Organization for Economic Co-operation and Development (OECD) have agreed to implement a global minimum tax in their tax regulations by the end of 2022,

Which will happen at a minimum corporate tax rate of 15 percent

The for large multinational companies Excluded. This was voted on in the plenary session of the European Parliament in Brussels in May.

However, towards the end of the year, it is likely that countries will not be able to meet this ambitious deadline, and according to tax experts, the most likely scenario is to postpone their submission to 2023. There are many reasons for the delay, including stalled negotiations in the European Union, First because of a Polish and then a Hungarian veto, as well as a disapproval by the United States Senate due to a dissenting vote of one. Democratic senator.

Hungarian position

The reason Hungary might veto is the unfair application of global minimum taxes

It would significantly weaken the competitiveness of the economy.

The corporate tax rate here is 9 percent, and the government doesn’t want to change it. Prime Minister Viktor Orban has called the global minimum tax a “job-killing measure”. One of the secrets of the success of the Hungarian economy is precisely the low level of taxation, so it is profitable for foreign companies to come here.

On the other hand, if the application of a global minimum tax does not imply a tax increase, this risk is eliminated, and thus the Hungarian government can accept its introduction already.

This is important because only a unanimous decision can be reached on the issue of minimum tax, This is not possible without Hungary can be achieved.