[{“available”:true,”c_guid”:”12488c8e-8f8c-495d-82a0-c4045b2824a8″,”c_author”:”hvg.hu”,”category”:”elet”,”description”:”Egy nőt \”mumifikálódott és csontvázszerű állapotban\” találtak meg – írja a SkyNews.”,”shortLead”:”Egy nőt \”mumifikálódott és csontvázszerű állapotban\” találtak meg – írja a SkyNews.”,”id”:”20230127_Harom_es_fel_evig_fekudt_holtan_egy_no_a_lakasaban_mire_eszrevettek”,”image”:”https://api.hvg.hu/Img/ffdb5e3a-e632-4abc-b367-3d9b3bb5573b/12488c8e-8f8c-495d-82a0-c4045b2824a8.jpg”,”index”:0,”item”:”cffd69b3-062d-4840-8de0-ccad50813c67″,”keywords”:null,”link”:”/elet/20230127_Harom_es_fel_evig_fekudt_holtan_egy_no_a_lakasaban_mire_eszrevettek”,”timestamp”:”2023. január. 27. 19:36″,”title”:”Három és fél évig feküdt holtan egy brit nő a lakásában, mire észrevették”,”trackingCode”:”RELATED”,”c_isbrandchannel”:false,”c_isbrandcontent”:false,”c_isbrandstory”:false,”c_isbrandcontentorbrandstory”:false,”c_isbranded”:false,”c_ishvg360article”:false,”c_partnername”:null,”c_partnerlogo”:”00000000-0000-0000-0000-000000000000″,”c_partnertag”:null},{“available”:true,”c_guid”:”40bba72f-3598-44e7-b420-73d806ff3f78″,”c_author”:”hvg.hu”,”category”:”itthon”,”description”:”A nő életveszélyes sérülésekkel került kórházba.”,”shortLead”:”A nő életveszélyes sérülésekkel került kórházba.”,”id”:”20230127_fejszevel_esett_neki_elettarsanak_egy_vamospercsi_ferfi”,”image”:”https://api.hvg.hu/Img/ffdb5e3a-e632-4abc-b367-3d9b3bb5573b/40bba72f-3598-44e7-b420-73d806ff3f78.jpg”,”index”:0,”item”:”e2186aa6-7c3c-4ebb-8371-dfe03665670d”,”keywords”:null,”link”:”/itthon/20230127_fejszevel_esett_neki_elettarsanak_egy_vamospercsi_ferfi”,”timestamp”:”2023. január. 27. 12:28″,”title”:”Fejszével esett neki élettársának egy vámospércsi férfi”,”trackingCode”:”RELATED”,”c_isbrandchannel”:false,”c_isbrandcontent”:false,”c_isbrandstory”:false,”c_isbrandcontentorbrandstory”:false,”c_isbranded”:false,”c_ishvg360article”:false,”c_partnername”:null,”c_partnerlogo”:”00000000-0000-0000-0000-000000000000″,”c_partnertag”:null},{“available”:true,”c_guid”:”34d2780f-0b52-471d-bd02-b8ba571c7b2f”,”c_author”:”Bedő Iván”,”category”:”360″,”description”:”Az új elmélet nagyjából ugyanúgy nem bizonyítható, mint sok más feltételezés.”,”shortLead”:”Az új elmélet nagyjából ugyanúgy nem bizonyítható, mint sok más feltételezés.”,”id”:”20230128_maskepp_forog_a_Fold_belso_magja_szuperrotacio_magnesesseg”,”image”:”https://api.hvg.hu/Img/ffdb5e3a-e632-4abc-b367-3d9b3bb5573b/34d2780f-0b52-471d-bd02-b8ba571c7b2f.jpg”,”index”:0,”item”:”2fc29b66-4b24-4ee9-954e-b8f32112f32c”,”keywords”:null,”link”:”/360/20230128_maskepp_forog_a_Fold_belso_magja_szuperrotacio_magnesesseg”,”timestamp”:”2023. január. 28. 16:00″,”title”:”Tényleg másképp forog a Föld belső magja?”,”trackingCode”:”RELATED”,”c_isbrandchannel”:false,”c_isbrandcontent”:false,”c_isbrandstory”:false,”c_isbrandcontentorbrandstory”:false,”c_isbranded”:false,”c_ishvg360article”:true,”c_partnername”:null,”c_partnerlogo”:”00000000-0000-0000-0000-000000000000″,”c_partnertag”:null},{“available”:true,”c_guid”:”9c995db1-ff5a-403e-9120-d06a2ed10ab3″,”c_author”:”hvg.hu”,”category”:”vilag”,”description”:”Putyin februárban vagy márciusban újabb nagyszabású offenzívára készül Ukrajnában, és egy évekig tartó, elhúzódó háborúra készül – mondták a Kremlhez közel álló bennfentesek a Bloomberg hírügynökségnek. Mindeközben Moszkva egy tűzszünetet is tető alá szeretne hozni, de csak azért, hogy időt nyerjen a feltöltődésre. Az, amit a Bloombergnek az orosz forrásai a háborúról mondtak, sok mindenben hasonló ahhoz, mint amit Orbán Viktor gondol róla. Az egyik közös pont, hogy Putyin mindenáron győzni szeretne.”,”shortLead”:”Putyin februárban vagy márciusban újabb nagyszabású offenzívára készül Ukrajnában, és egy évekig tartó, elhúzódó…”,”id”:”20230127_Bloomberg_Putyin_komoly_tamadasra_keszul”,”image”:”https://api.hvg.hu/Img/ffdb5e3a-e632-4abc-b367-3d9b3bb5573b/9c995db1-ff5a-403e-9120-d06a2ed10ab3.jpg”,”index”:0,”item”:”ed61e870-7e38-447a-9557-6193efe7010f”,”keywords”:null,”link”:”/vilag/20230127_Bloomberg_Putyin_komoly_tamadasra_keszul”,”timestamp”:”2023. január. 27. 19:00″,”title”:”Bloomberg: Putyin komoly támadásra készül, el is húzná a háborút”,”trackingCode”:”RELATED”,”c_isbrandchannel”:false,”c_isbrandcontent”:false,”c_isbrandstory”:false,”c_isbrandcontentorbrandstory”:false,”c_isbranded”:false,”c_ishvg360article”:false,”c_partnername”:null,”c_partnerlogo”:”00000000-0000-0000-0000-000000000000″,”c_partnertag”:null},{“available”:true,”c_guid”:”cf9fdca7-024c-459a-961b-6c8709893ed4″,”c_author”:”HVG360″,”category”:”360″,”description”:”A lap első számú európai tudósítója úgy látja, hogy az agresszió nyomán növekedett azoknak a közép-, illetve kelet-európai országoknak a befolyása, amelyek negatívan vélekednek Oroszországról, ugyanakkor gyengültek a német és francia pozíciók. Ezzel párhuzamosan felerősödtek a törekvések az EU és a NATO bővítésére. Az Unió esetében ez a Nyugat-Balkánt jelenti, illetve azt, hogy Ukrajna és Moldova jelölti státuszt kap.”,”shortLead”:”A lap első számú európai tudósítója úgy látja, hogy az agresszió nyomán növekedett azoknak a közép-, illetve…”,”id”:”20230127_New_York_Timeselemzes”,”image”:”https://api.hvg.hu/Img/ffdb5e3a-e632-4abc-b367-3d9b3bb5573b/cf9fdca7-024c-459a-961b-6c8709893ed4.jpg”,”index”:0,”item”:”e24106a8-ce99-4eaa-8547-ab6f45daa2e7″,”keywords”:null,”link”:”/360/20230127_New_York_Timeselemzes”,”timestamp”:”2023. január. 27. 15:00″,”title”:”New York Times-elemzés: A háború rásegít, hogy erősödjön Kelet-Európa “,”trackingCode”:”RELATED”,”c_isbrandchannel”:false,”c_isbrandcontent”:false,”c_isbrandstory”:false,”c_isbrandcontentorbrandstory”:false,”c_isbranded”:false,”c_ishvg360article”:true,”c_partnername”:null,”c_partnerlogo”:”00000000-0000-0000-0000-000000000000″,”c_partnertag”:null},{“available”:true,”c_guid”:”1c244c25-409b-461e-b615-171000807efd”,”c_author”:”hvg.hu”,”category”:”gazdasag”,”description”:”Ha az amerikai kormány nem emeli meg időben az adósságplafont, a gazdasági és pénzügyi bizonytalanság növekedni fog, és felveti az amerikai adósságtörlesztés nemteljesítésének veszélyét, ami recessziót idézhet elő – írja a Stratfor geopolitikai elemzőcég. “,”shortLead”:”Ha az amerikai kormány nem emeli meg időben az adósságplafont, a gazdasági és pénzügyi bizonytalanság növekedni fog, és…”,”id”:”20230127_A_Statfor_szerint_recessziot_idezhet_elo_ha_az_USA_nem_noveli_meg_idoben_az_adossagplafonjat”,”image”:”https://api.hvg.hu/Img/ffdb5e3a-e632-4abc-b367-3d9b3bb5573b/1c244c25-409b-461e-b615-171000807efd.jpg”,”index”:0,”item”:”4448b2bb-1bd1-448a-80d7-c5260f0854b0″,”keywords”:null,”link”:”/gazdasag/20230127_A_Statfor_szerint_recessziot_idezhet_elo_ha_az_USA_nem_noveli_meg_idoben_az_adossagplafonjat”,”timestamp”:”2023. január. 27. 20:07″,”title”:”A Stratfor szerint recessziót idézhet elő, ha az USA nem növeli meg időben az adósságplafonját”,”trackingCode”:”RELATED”,”c_isbrandchannel”:false,”c_isbrandcontent”:false,”c_isbrandstory”:false,”c_isbrandcontentorbrandstory”:false,”c_isbranded”:false,”c_ishvg360article”:false,”c_partnername”:null,”c_partnerlogo”:”00000000-0000-0000-0000-000000000000″,”c_partnertag”:null},{“available”:true,”c_guid”:”9f0f8964-73ba-4f2a-b539-bc3974155606″,”c_author”:”hvg.hu”,”category”:”vilag”,”description”:”Emellett növelni fogják a megszállt területeken állomásozó izraeli katonák számát is.\n\n”,”shortLead”:”Emellett növelni fogják a megszállt területeken állomásozó izraeli katonák számát is.\n\n”,”id”:”20230129_Megkonnyitenek_Izraelben_a_fegyverviselest_a_hetvegi_terrortamadasok_miatt”,”image”:”https://api.hvg.hu/Img/ffdb5e3a-e632-4abc-b367-3d9b3bb5573b/9f0f8964-73ba-4f2a-b539-bc3974155606.jpg”,”index”:0,”item”:”921cd9a7-b4b2-464b-ad1a-8617c5e95b5f”,”keywords”:null,”link”:”/vilag/20230129_Megkonnyitenek_Izraelben_a_fegyverviselest_a_hetvegi_terrortamadasok_miatt”,”timestamp”:”2023. január. 29. 09:08″,”title”:”Megkönnyítenék Izraelben a fegyverviselést a hétvégi terrortámadások miatt”,”trackingCode”:”RELATED”,”c_isbrandchannel”:false,”c_isbrandcontent”:false,”c_isbrandstory”:false,”c_isbrandcontentorbrandstory”:false,”c_isbranded”:false,”c_ishvg360article”:false,”c_partnername”:null,”c_partnerlogo”:”00000000-0000-0000-0000-000000000000″,”c_partnertag”:null},{“available”:true,”c_guid”:”623fa5e5-e3ce-4580-a246-b84257c7bb68″,”c_author”:”MTI/hvg.hu”,”category”:”itthon”,”description”:”„Ezek az emberek valószínűleg még nem élveztek egyetlen futballmeccset sem, sosem azért mennek ki a stadionokban, hogy jól érezzék magukat, hanem hogy nézzék, mit lehet feljelenteni” – vélekedett a miniszter.”,”shortLead”:”„Ezek az emberek valószínűleg még nem élveztek egyetlen futballmeccset sem, sosem azért mennek ki a stadionokban…”,”id”:”20230127_szijjarto_peter_nagy_magyarorszag_molino_zaszlo”,”image”:”https://api.hvg.hu/Img/ffdb5e3a-e632-4abc-b367-3d9b3bb5573b/623fa5e5-e3ce-4580-a246-b84257c7bb68.jpg”,”index”:0,”item”:”4aa9a9e3-4e85-42c2-bef1-523592e4ac0a”,”keywords”:null,”link”:”/itthon/20230127_szijjarto_peter_nagy_magyarorszag_molino_zaszlo”,”timestamp”:”2023. január. 27. 15:12″,”title”:”Szijjártó lemunkásőrözte az UEFA rasszizmus elleni szervezetét a nagy-magyarországos zászlók ügyében”,”trackingCode”:”RELATED”,”c_isbrandchannel”:false,”c_isbrandcontent”:false,”c_isbrandstory”:false,”c_isbrandcontentorbrandstory”:false,”c_isbranded”:false,”c_ishvg360article”:false,”c_partnername”:null,”c_partnerlogo”:”00000000-0000-0000-0000-000000000000″,”c_partnertag”:null}]

Order the weekly HVG newspaper or digitally and read us anywhere, anytime!

That’s why we ask you, our readers, to support us! We promise to keep doing the best we can!

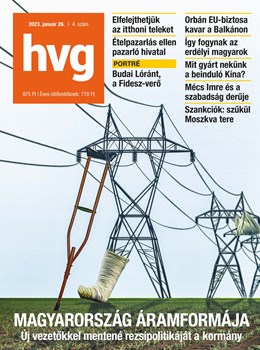

We recommend it from the first page