Banking IT security issues and major payment trends will also be discussed at the Banking Wallet Technology Conference on October 13th. Register here!

We’ve written several times in recent weeks and months about Scammers apply For bank client money, we also presented some interesting individual cases. This was the case, for example, when a fraudulent company attempted to defraud the same balustrade on more than one target. Based on information available online, they have experienced at least hundreds of cases, including one (in terms of) successful abuse. inform us When a larger amount was fraudulently allocated to the purchase of a home.

At the end of spring and the beginning of summer, the Public Prosecutor’s Office (which, according to many indicators, is often the largest bank for scammers as the largest) reported several cases of phishing. the side, And last week about an SMS-based phishing attempt A warning has been issued.

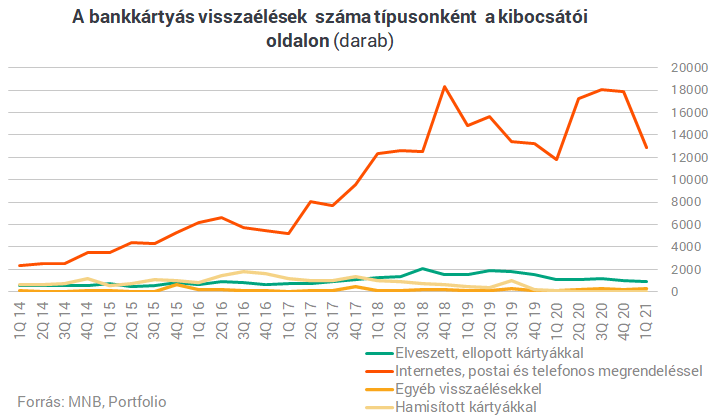

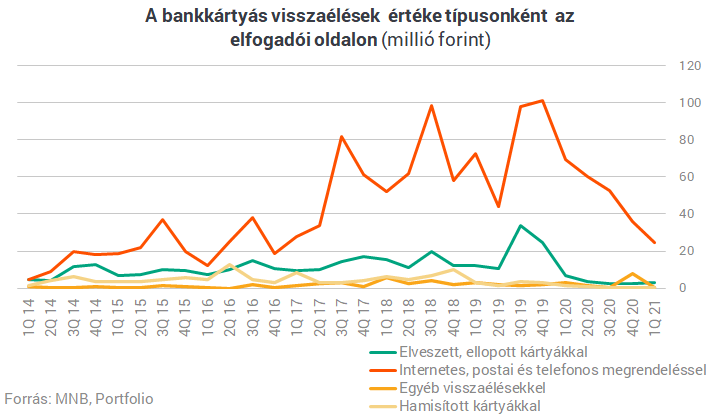

Given the topic of the hour, we thought it worthwhile to reconsider how fraud statistics evolve. Quarterly data published by MNB shows that although successful frauds in electronic payments were widespread in previous years, when frauds successfully executed amounted to 1 billion HUF in a quarter, last year – even if the base was low. The crooks seemed more active and successful.

In its latest issue for the first quarter of this year, MNB notes that “the number and value of successful violations in electronic payments has also increased significantly compared to the same period of the previous year, but it is still very low. 331 successful overruns and a loss of 579 million HUF are still negligible in comparison to the trading volumeMost of the fraud was committed via the Internet channel, which amounted to 337.6 million HUF, and through the customer terminal, which amounted to approximately 194.7 million HUF.

We know that in the case of fraud cases, corporate customers occur in larger amounts, when the fraud value index jumps a lot with each transaction. Scammers are also active on social media, and it is also common for them to report via a seemingly official email to notify company employees that the partner’s account number is changing.

Fraudulent tactics range from clumsy and hard-to-understand spam to professionally organized phishing scams, and it is common experience that even the most transparent attempts to scam with grammatically incorrect characters are sometimes targeted. It is important that banks never ask for passwords and PINs from their customers, never ask for a card’s CVC, and never ask that customer to transfer to another bank account.

Banks have advanced security systems and a serious security team, so fraudulent or suspicious transactions can be caught before money is lost. Although banks are reluctant to communicate what they can monitor, they often pay attention to suspicious net banking activity: they notice unusual and strange patterns, intervene, if necessary, and contact the customer. For example, if someone arrives from a foreign IP address and changes the language – which has never happened before – they can sound an alarm, but they can even deduce a fraudulent transaction from using the keyboard. Anyone who normally types slowly, but is now suddenly littered with several keystrokes within a second, will be suspicious again.

However, banks run serious campaigns to prevent scammers from misleading customers, and we know that regulators are also looking for ways to reduce fraud more effectively.

In the area of card abuse, Hungary also occupies a very good position in international comparisons at the European level, the number of abuse cases is still low compared to card traffic, and this has not changed in the recent period, since card traffic is also a rising trend.

Systematic interpretation In its statistics, the MNO distinguishes between excesses on the source side and the accepted one; It would not be correct to simply add the values in the numbers that show its evolution, as the two data sets contain overlap. Abusive transactions with a card issued by a local bank at a local merchant are included in both stats. The latter cases represent only one-tenth of the violations (that is, approximately 5-5 percent of the two data sets must be deducted to make the data additive). The explanation for this is that data and cards stolen in Hungary are usually misused abroad, while Hungarian acceptors commit fraud using card data and cards obtained in another country.

![Deleted version of Nintendo 64 Tomb Raider playable! [VIDEO]](https://thegeek.hu/wp-content/uploads/sites/2/2024/04/theGeek-Riqa-Nintendo.jpg)