The minimum 15% proposed by the US Treasury and the 21% tax that the Biden government intends to introduce differs between foreign revenues for US companies, and this is good evidence of ongoing negotiations within the Organization for Economic Cooperation and Development on global minimum taxes. Many countries, like Ireland, operate with much lower taxes. The negotiations are due to be completed by the summer.

US Treasury Secretary Janet Yellen ambitiously wanted to reduce the global competition in which countries compete with each other for corporate taxes, causing countries’ budgets to suffer from a shortage of tax revenue. This is especially bad for budgets in a period of rising deficits and public debt in the wake of the coronavirus pandemic. Janet Yellen’s stance is a sharp shift from the dismissive behavior of former President Donald Trump.

The 15% that the Americans proposed is already very close to the 12.5% that was negotiated by the Organization for Economic Cooperation and Development, which appeared to be a consensus even before the United States joined. TheZ- The convergence of the American position at this level increases the chances of agreement.

It is noteworthy that regarding the OECD meeting this week, Foreign Minister Peter Szegarto indicated that the Hungarian government firmly rejected the idea of imposing a global minimum tax (at that time it was only possible to know the level of 21%), because the government. However, in the meantime, it is urging the world to take action against the tax evasion practices of major tech companies and Moltis, which a global tax minimum is close to achieving. Read more:

Japanese Finance Minister Taro Aso said the US proposal appeared to be closer to what other countries might accept, but negotiations still needed. He expects no agreement to be reached by the second half of the year. The US’s 21% plan to tax its companies abroad is considered high by both the Irish and the British, although the latter applies a 25%.

Incidentally, Democrats plan to raise corporate tax revenues to 28% in-country from the current 21%, wanting to provide funding for Joe Biden’s infrastructure development plan. Republicans are opposed to both higher global tax levels and local corporate taxes, and not all Democrats support them.

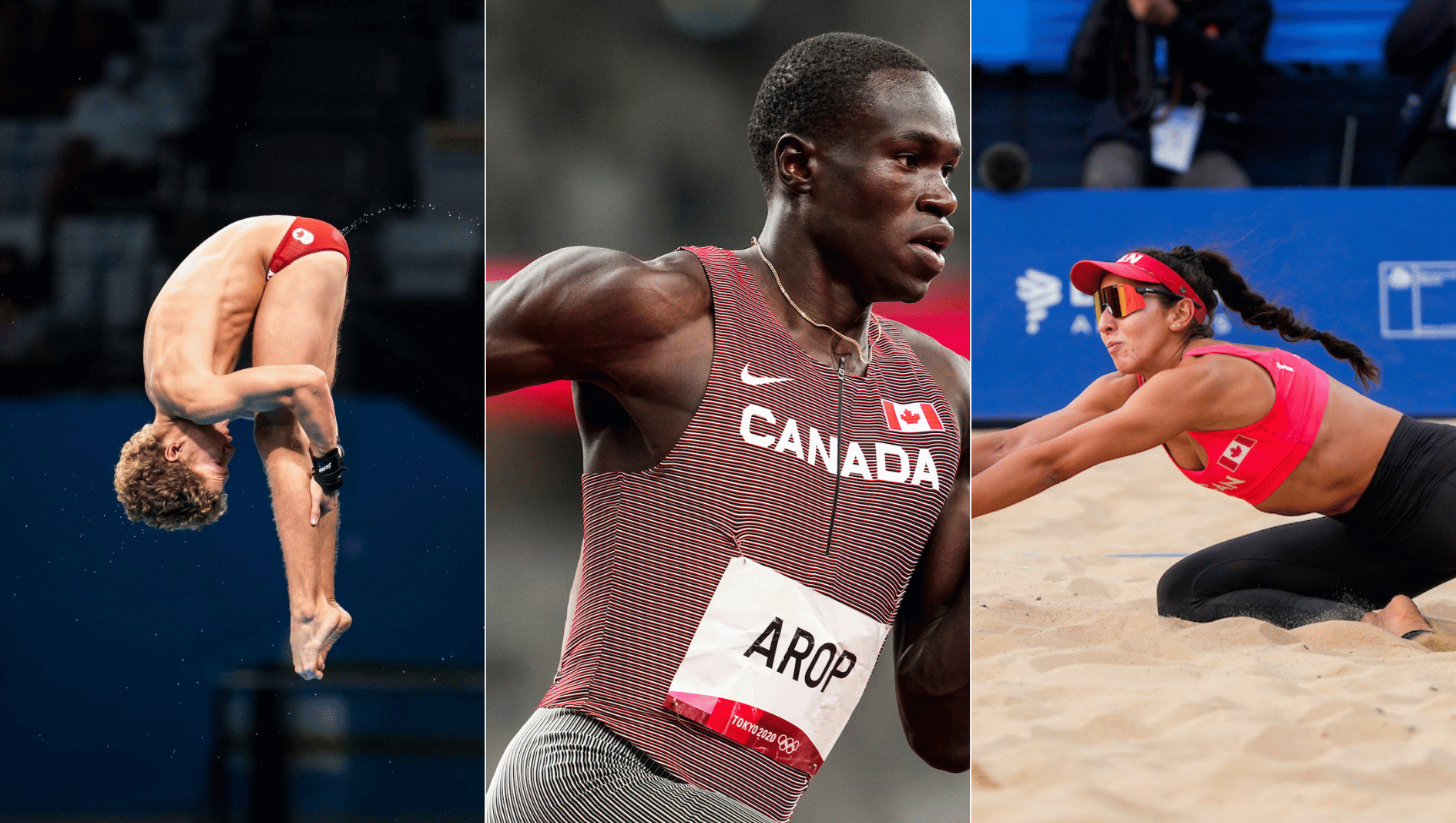

Cover photo: Getty Images